Equate stock traders with poker players.

I see what you are saying, but I don't take it quite that far. I look at trading securities like I would look at trading junk from yard sales.

Let's say, for example, that I find an old hammer at a yard sale. I buy it for a dollar, and the next week, I have a yard sale of my own and sell it for two dollars. 100% profit.

Obviously, trading securities is more complicated that this; I'm just sharing the underlying principle. Most of these "day trader" types do no research and operate on "hunches" (or "press releases" from pump and dump machines), while trying to earn $1MM off of a single $5 penny stock purchase. If they focused on finding undervalued securities and taking 10-20% gains (after commissions and taxes), they would do far better. A 10% gain in a month equates to a 120% annual return but too many people want to double their money every five minutes and that unrealistic goal leads to poor trading decisions.

Again, I'm not discounting what you mention about possible corruptions in the market, I'm just saying that wise trading is not gambling in the truest sense of the word.

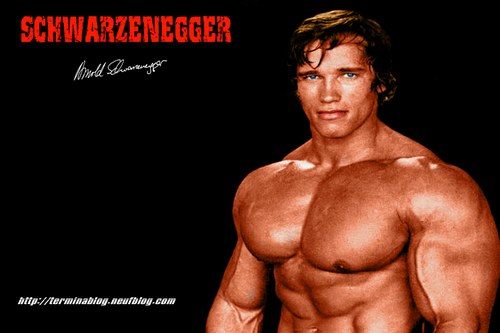

And to make this post bodybuilding related...