Peter Schiff is no doubt a smart guy, he has some sound advice and principals but his arrogance in the field is truly unsettling. People love to talk about Obamas arrogance, and i agree it's unsettling when it's shown, for example the way he must manage everything and have a comment on everything. Seems a little autocratic to me. But with Schiff we hear none of this because apparently he is ALWAYS right. After a little digging i found some information as well as a response by Schiff himself. Read (without prejudice), discuss and make up your own mind.

http://www.erictyson.com/articles/20090213During the sharp and volatile stock market slide of 2008-09, Peter Schiff, who heads the brokerage firm, Euro Pacific Capital based in Darien, CT with five branch offices in California, Florida and Arizona, has frequently been on television, especially the cable channels including CNBC. His book, Crash Proof: How to Profit From the Coming Economic Collapse (Wiley) is a national best-seller. Along with a growing chorus of others such as Nouriel Roubini, Barry Ritholtz, and Gary Shilling, Schiff is one of those guys now saying "I told you so" in reference to the recent economic and financial market problems.

Schiff's quote used for the headline of this article ("The reality is I don't think I've been wrong on anything") comes from an interview U.S. News & World Reports magazine did with Schiff in their May 30, 2008 issue. (In that piece, Schiff made a number of predictions I will get to in a moment.) The quote came from comments he made when discussing the supposed accuracy of his predictions over the past decade.

Peter Schiff began his career in the financial services world as a stockbroker, doing what I thought I wanted to do when I grew up. (I lost interest in the job once I learned about selling and working on commission). My dad used to take me to visit his broker at Merrill Lynch. Mind you, my dad was no high roller but he had begun handling some investments when he was laid off from his job as a mechanical engineer during the severe recession of 1973-74.

In watching and reading his interviews and in speaking with Schiff myself on February 12th, 2009, I am struck by the forcefulness and certainty of his views and predictions. He doesn't hedge and as he did in the U.S News interview, he told me, "Pretty much everything is happening as I scripted it to happen with minor exceptions..."

When I asked Schiff what training and experiences he had to form his economic views and opinions, I asked if he was an economist or had any economics training. "I think I know more about economics than anyone with the title and I know more than anyone in government," he boasted, adding, "These other guys are witch doctors and I'm the real doctor."

As for when he developed his economic genius, Schiff told me, "I've always known this much -ever since I was a kid and my dad wrote a book called the Biggest Con: How the Government is Fleecing You, I understood capitalism and how it works. I read Ayn Rand and I read some of the Keynesian economics stuff and could see why those economists were all wrong."

Schiff's father, Irwin Schiff, is a long-term tax protestor who has written many books about the supposed illegality of the U.S. income tax system. Unfortunately the senior Irwin didn't read the section in my Taxes for Dummies about what happens to folks who refuse to pay their income taxes because they don't believe in the validity of our nation's tax laws. Sadly, Irwin Schiff, now in his 80s, has been convicted of numerous federal income tax crimes and is currently serving another lengthy prison term.

Interestingly, in the marketing copy for Irwin Schiff's book, The Biggest Con, it says of the book, "It will convince you that most American ‘economists' don't know what they are talking about - which is why this country is in such deep economic and financial trouble. It provides irrefutable proof of how the federal government has been continually undermining the American economy and forcing a lower standard of living on us all." This sounds a lot like the recent statements of his son Peter yet the father's book was published back in 1977! (You know the expression about the apple not falling far from the tree...) Before I get to Peter Schiff's more recent predictions, I was able to track down some of his older ones. I always enjoy doing this for prognosticators like Schiff who claim as he did to U.S. News last year that, "The reality is I don't think I've been wrong on anything," in reference to his predictions over the past decade. Let's take a look at that bold claim.

Thanks to the wonders of video technology, we have an accurate record of Schiff's views from this 2002 television interview. What is notable here is that in this 2002 interview, Schiff was saying nearly the same exact things that he did during 2008 and in his recent interview with me.

At the time of this 2002 interview, the U.S. stock market had already suffered steep losses and the economy was in recession at the time of this 2002 interview. The highlights of Schiff's predictions: he saw substantial downside over the next couple of years for the stock market. He predicted that the Dow, which was around 10,000 at the time, would plummet to between 2,000 and 4,000 and he even went so far as to say that the Dow might fall below 2,000. He expected the NASDAQ to drop to 500 from its then level of 1,700. He also said that the dollar was going to fall sharply and interest rates were going to go through the roof accompanied by dramatic inflation.

On all of these counts, Schiff wasn't just wrong but ended up being hugely wrong.

Now, fast forward to May 30, 2008 and the U.S. News article, "Permabear Peter Schiff's Worst-Case Scenario." Let's review some of the key predictions he made in that piece As for his investing predictions he said, "I'm getting my clients' money outside of the United States as fast as they can send it to me...You've got to own resources and energy...I've been buying gold, silver, industrial metals, and all kinds of stocks. My main theme is the global economy will survive and the U.S. economy is a disaster. Everything is about how you benefit from the increased purchasing power and rising standard of living in the rest of the world."

This was wrong as commodity prices have plunged since this interview (see graph below). Foreign stocks actually declined more in 2008 than did U.S. stocks so Schiff was wrong on that count too.

When asked, "Why don't you think soaring oil, grains, or commodities prices are the next bubble?" Schiff replied:

"These prices do not constitute bubbles. They simply constitute the repricing of goods to reflect the diminished value of our money. The way you can tell there's not a bubble is that these markets are clearing. People are buying food and eating it. They're buying gasoline and using it. Speculators aren't buying gasoline and warehousing it in big facilities because they think the price is going to go up." Schiff went on to say,

"Gold is going to be $1,200 to $1,500 by the end of the year."

"Oil prices had a pretty big run and might not make more headway by the end of the year. But we could see $150 to $200 next year."

"At a minimum, the dollar will lose another 40 to 50 percent of its value."

iShares S&P Commodity Price Index

Well, Schiff was wrong on these 2008 predictions on gold, and wrong on oil, which plunged with the commodity bubble bursting. When asked, "So how bad do you think this economy will get?" Schiff said, "We're going through a very rough period in our history. In many ways, it's going to be worse than the Depression." That's what prompted my call to Schiff to explain this stunning statement.

"During the depression, the U.S. economy was actually still fundamentally sound. The U.S. government created the great depression...Japan's government made the same mistakes in the 1990s and made the downturn worse and longer lasting," he said. He went on to explain, "We allowed our economy to move from producing goods to a service economy. Our economy now is completely phony."

In his 2002 television interview I discussed earlier, Schiff similarly argued that the U.S. economy would crater because of the decline of our manufacturing base. Perhaps if Schiff had studied some basic economics, he would have learned that economies change and that's not a bad thing. If Schiff had lived 100 years ago, he would have been screaming over the decline of our farming industry. And, as I recently discussed in my review of Jeremy Siegel's classic book, Stocks for the Long Run, the changing composition of our industry base is not in and of itself concerning in our global economy. We actually have a highly diverse economy.

In my recent interview of Schiff, sounding a lot like he did back in 2002, he said, "The government is trying to fix the economy through intervention and will make the situation worse. We can't afford all of this government. The dollar is still rising and the world is still giving us more rope to hang ourselves. The dollar will plunge and that will cause rapid inflation and high interest rates." As for being wrong on commodity prices last year, Schiff maintains that prices will make new highs and the only reason that hasn't happened yet is because the dollar hasn't yet collapsed.

Why hasn't this yet happened and why did commodity prices collapse in late 2008 while investors worldwide bought U.S. Treasury bonds and bills? "I overestimated the intelligence of the world to see the coming inflation," Schiff told me.

In summary, Schiff reminds me very much of Douglas Casey who wrote the 1980 best-seller Crisis Investing: Opportunities and Profits in the Coming Great Depression. Casey predicted soaring inflation and commodity prices and a plunging U.S. dollar. Schiff has been singing this same song for many years. The vast majority of Schiff's market and economic calls have been significantly off.

He appears to have built himself a profitable brokerage business by harping on the simple message that the U.S. is going down the tubes and you've got to get your money overseas and into commodities. However, his clients' performance (apparently following his risky and flawed predictions) has been sub-par as has been documented in numerous sources, most recently in this Wall Street Journal article.

As I've long argued, stock market investors should hold plenty of overseas stocks for diversification purposes and to benefit from foreign economies growing faster than the U.S. economy. However, buying individual stocks as Schiff advocates is costly (although profitable for his brokerage firm). Commodity investments is a high risk, dangerous game for novice investors and the only long-term winner there is usually the broker getting a piece of the trades and investments. Over the very long-term, commodity prices and gold have barely kept investors up with the rate of inflation. Over brief periods of unexpectedly higher inflation, such investments tend to do well but timing such moves is quite difficult to do.

Update on 2/23/09: I just got off the phone from doing a radio interview with Jason Hartman for his real estate and financial show. Early on, he asked me about various gurus and Peter Schiff's name quickly came up. Schiff he said had been a guest on his program in the past. Without missing a beat, Mr. Hartman proceeded to tell me how he invested $200,000 through Schiff's firm and now had just half of that left!

Copyright Eric Tyson, 2008 - 2010 all rights reserved.

Eric Tyson is the only best-selling personal finance author who has an extensive background as an hourly-based financial advisor and who does not accept speaking fees, endorsement deals or fees of any type from companies in the financial services industry or product or service providers recommended in his articles, books and his publications.

http://globaleconomicanalysis.blogspot.com/2009/01/peter-schiff-was-wrong.htmlThere are numerous YouTube videos, articles, and references to Peter Schiff being "right" rapidly circulating the globe. While Schiff was indeed correct about the US imploding, most of the praise heaped on Schiff is simply unwarranted, and I can prove it.

First, let's start with a look at the claim being made. Peter Schiff concludes many of his articles, books, etc. with the following statement.

Mr. Schiff is one of the few non-biased investment advisors (not committed solely to the short side of the market) to have correctly called the current bear market before it began and to have positioned his clients accordingly.

Highlight in red is mine.

I would like to see some proof of that statement. Specifically I would like to see the average returns posted by EuroPacific clients for 2008.

I have talked with many who claim they have invested with Schiff and are down anywhere from 40% to 70% in 2008. There are many other such claims on the internet. They are entirely believable for the simple reason Schiff's investment thesis was flat out wrong.

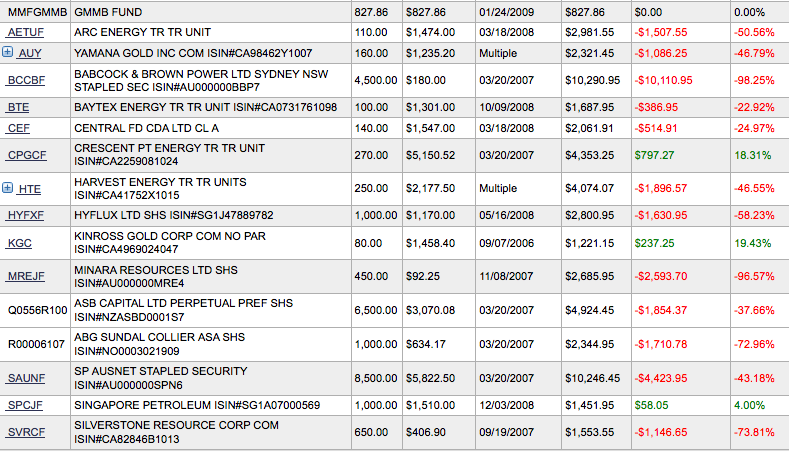

I have an actual portfolio statement from one of Schiff's clients at the end to discuss, for now let's discuss the main points of Schiff's thesis.

Schiff's Overall Thesis

* US Equity Markets Will Crash.

* US Dollar Will Go To Zero (Hyperinflation).

* Decoupling (The rest of the world would be immune to a US slowdown.

* Buy foreign equities and commodities and hold them with no exit strategy.

Schiff was correct about point number 1 above. The US equity markets crashed. That was a very good call. Unfortunately, his investment thesis centered on shorting the dollar in a hyperinflation bet, and buying foreign equities rather than shorting US equities.

Furthermore, Schiff made no allowances for being wrong and had no exit strategy whatsoever.

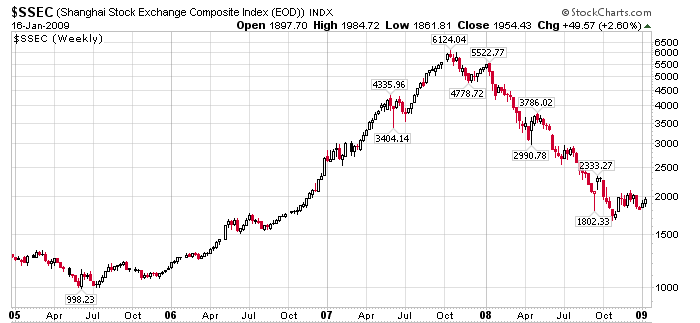

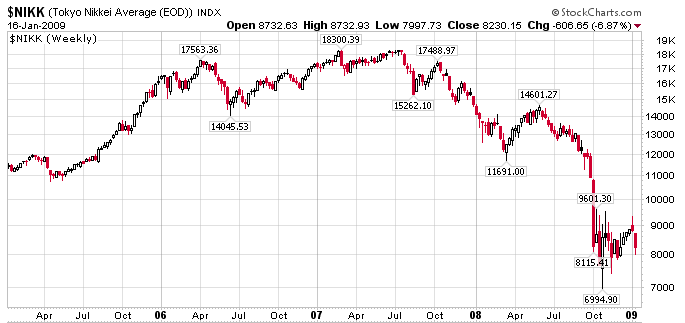

What happened in 2008 was that foreign equities sold off much harder than US equities, and a strengthening US dollar compounded the situation.

In other words, Schiff failed where it matters most: Peter Schiff did not protect his client's assets. Let's take a look how, and more importantly why, starting with charts of various foreign indices.

$SSEC Shanghai Stock Exchange Weekly

$NIKK Tokyo Nikkei Weekly Chart

$TSX - Canada TSX Weekly Chart

$AORD Australia ASX Weekly Chart

$SPX S&P 500 Weekly

12 Ways Schiff Was Wrong in 2008

* Wrong about hyperinflation

* Wrong about the dollar

* Wrong about commodities except for gold

* Wrong about foreign currencies except for the Yen

* Wrong about foreign equities

* Wrong in timing

* Wrong in risk management

* Wrong in buy and hold thesis

* Wrong on decoupling

* Wrong on China

* Wrong on US treasuries

* Wrong on interest rates, both foreign and domestic

That's a lot of things to be wrong about, especially given all the "Peter Schiff Was Right" videos floating around everywhere. The one thing he was right about was the collapse of US equities and no part of his investment strategy sought to make a gain from that prediction.

Peter Schiff concludes many of his articles, books, etc. with the claim he saw this coming and "positioned his clients accordingly".

'Dr. Doom' became a star by predicting last year's market meltdown. And now his 2009 forecast is even scarier.

Schiff did not invest for doom; he invested for a bull market that did not exist. He was wrong where it mattered most, protecting client assets. For this amazing feat, people think of him as a star.

An Actual Schiff Portfolio