Good read:

The Bit Short: Inside Crypto’s Doomsday Machine

Jan 14, 2021

https://crypto-anonymous-2021.medium.com/the-bit-short-inside-cryptos-doomsday-machine-f8dcf78a64d3

On January 8th, I saw this post on Hacker News about Tether manipulating the price of Bitcoin. That shook me: I’d assumed Tether had been purged from the crypto markets, yet apparently it was still around. But how much Tether could there really be in the crypto markets? Surely not that much.

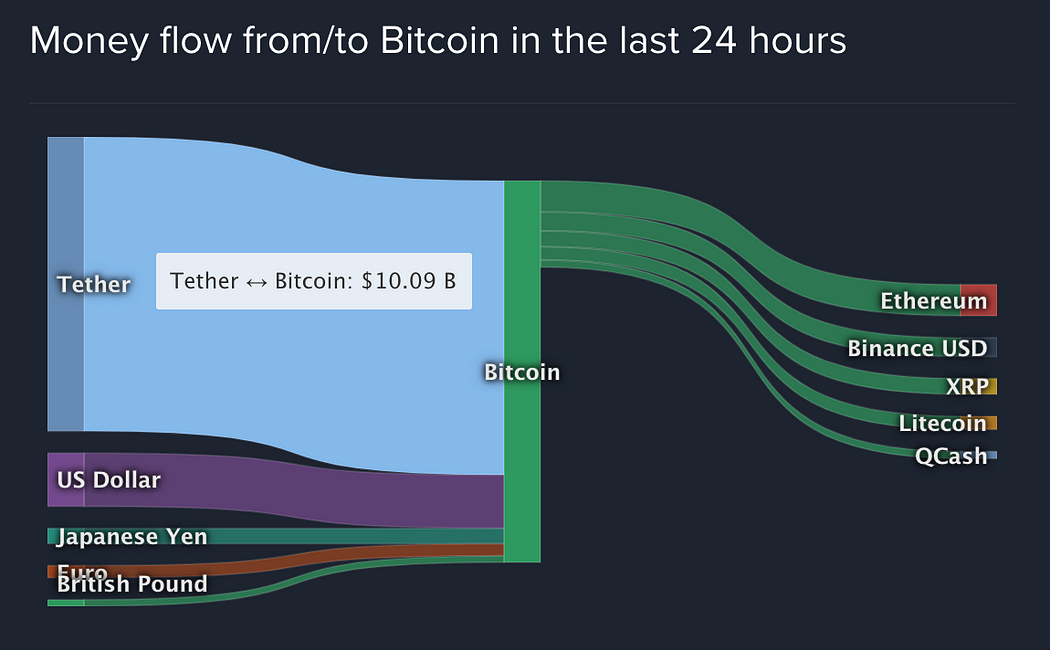

Still, I took a look. The answer, I was surprised to see, was a lot:

The upshot: over two-thirds of all Bitcoin — $10 billion worth of it — that was bought in the previous 24 hours, was being purchased with Tethers.

Practically all the crypto sold on these three exchanges was being bought with Tethers. None at all was being bought with USD.

Bitcoin was clearly correlated with Tether; Tether was clearly being issued at a frantic rate; and that issuance had a high probability of being backed by nothing at all.

It seemed I’d been wrong to dismiss Tether. Tether wasn’t just in the crypto markets — Tether was the crypto markets.

From January 2020 to September 2020, the amount of all foreign currencies held by all the domestic banks in the Bahamas increases by only $600 million — going from $4.7B to $5.3B. (The table is in Bahamian dollars, but the Bahamian dollar is pegged to the US dollar, so 1 BSD = 1 USD.)

But during the same period, total issued Tethers increased by almost $5.4 billion — going from $4.6B to $10B!

The implication was shocking: there weren’t nearly enough dollars in all the domestic banks in the Bahamas to back the Tethers that were floating around in the crypto market.

So this was crypto’s big short: Tether Ltd. was short of US dollars — to the tune of about $25 billion.

- - - - -

That's a summary of his key points.

He's basically arguing that Tether is issuing out tokens which aren't backed by USD (since they do not have anywhere near the funds or assets to back these amounts) but are still used to buy cryptocurrencies.

This is also the argument Roubini made against Tether and Bitcoin, that it's being manipulated, due to use of unbacked Tether tokens.