Few things I've been noticing as of the last few months..

Bitcoin is legal tender in El Salvador. The President of El Salvador just predicted (yesterday - on his Twitter) that 2 more countries will be adopting Bitcoin as legal tender. This is huge for BITCOIN, but I believe equally as massive for

ALGORAND. Algorand serves as the backbone for Bitcoin in El Salvador that allows for integration and functionality. Watch and see how Algorand will go parabolic during this year. Tons of venture capital money is pouring into it and it looks as if it will continue.

HBAR (Hedera Hashgraph) is looking ridiculously promising.

Quant looks very attractive as essentially the Windows Operating system of cryptos.

Would consider looking into the ISO 20022 compliant cryptos if you want to possibly have a safe hedge against future crypto market disruptions. If you haven't looked into it before, SWIFT is the Society for Worldwide Interbank Financial Telecommunication and it serves as an intermediary and executor of financial transactions between banks worldwide. In terms of what ISO 20022 is, the SWIFT community has decided that by 2025 the high value payment systems of all major reserve currencies will have move to ISO 20022. As a result of this, banks and the SWIFT community have decided that all financial institution (FI) to financial institution (FI) payments need to move to the standard. Adoption of ISO 20022 began in November 2021. This will be followed by a four year period of coexistence with legacy SWIFT MT standards which will end in November 2025.

What are the cryptocurrencies that are ISO 20022 compliant? Below you can find them for your viewing pleasure:

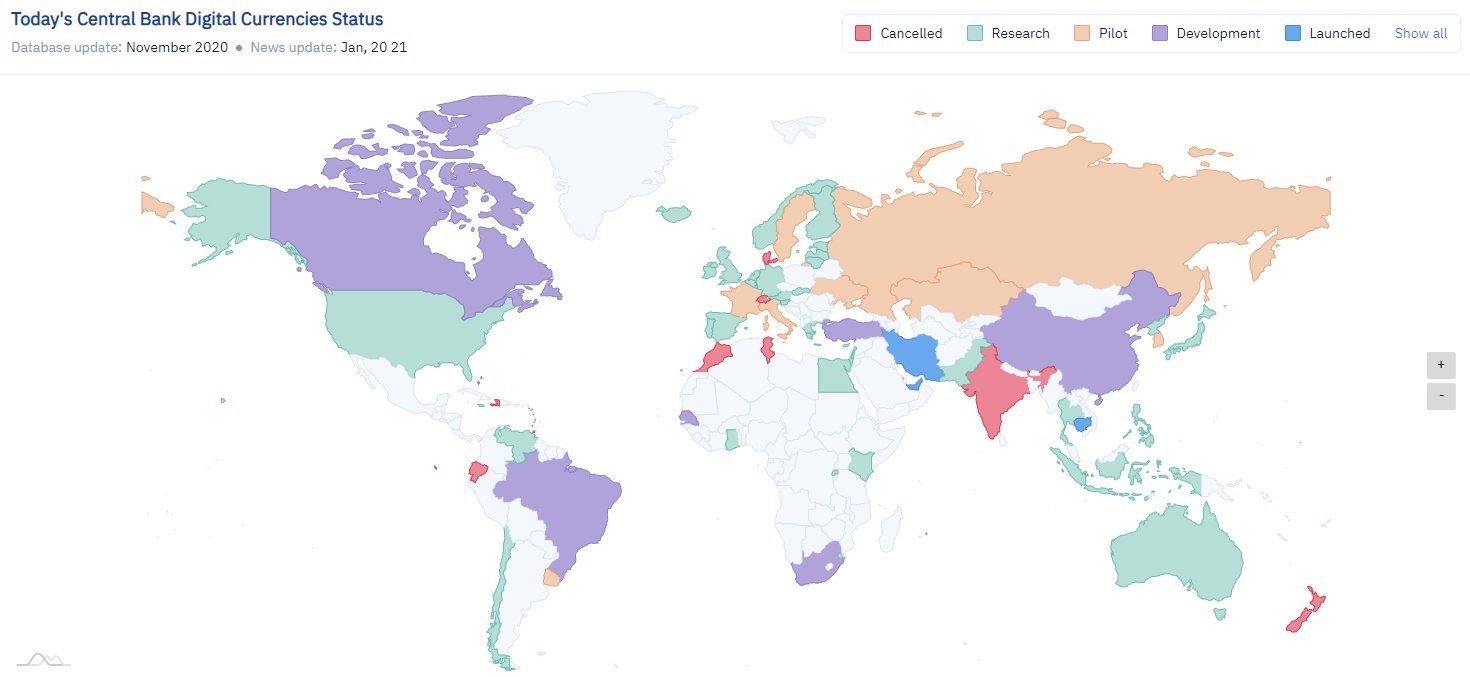

I am not saying these cryptos will become the next Bitcoin(s) of our decade, but consider that they will likely be very safe hedges in a sea of thousands of available cryptos. Some of you know that I tend to be a very safe investor regardless of asset class and when it comes to crypto, it's no different for me. These aforementioned cryptos seem like very safe bets. Keep in mind that many countries are also developing/researching their central bank digital currencies and if you look into what platforms some countries are using, you will find that both XDC and XLM are being heavily researched and/or piloted. For more information on what countries are developing/researching their own digital currencies and what technology platforms they are testing with, feel free to go to this website:

https://cbdctracker.org/Once you go to that site, it will give you an interactive map that you can use to individually click on countries/territories and further investigate what platforms they are using to develop their own central bank digital currencies (looks like the image below). If for instance you click on Canada, they are already in a pilot stage and are using R3 Corda, which uses the

XDC token as the primary settlement coin.

Again, this is not to say that these ISO 20022 compliant cryptos are your sure bet to guaranteed fortune, but it certainly points towards them having true, international utility/purpose in the large stage of international banking and monetary funds. As always, I am just an accountant and not a financial advisor. This material is just based on a little research and talk amongst a few old Jews.

"

1"