I am no longer a retail brokerage IA, as I have explained several times in this thread. Are you even reading my posts, or just trolling me?

I now have a private investment fund of accredited investors, as I have said several times... I AM NO LONGER A RETAIL BROKER!

Now and as an IA I mostly got paid by amount of assets managed. The difference is now I can charge a % on profits. You obviously don't know what an IA is. You think IA and retail registered rep are the same thing. I explained the difference in a previous thread. I don't feel like repeating the same Dick and Jane info to you over and over. Go back and read from page 2 forward. You probably didn't even START reading until after you posted that brilliant assertion that longterm investing and day trading are the same thing.

I AM NO LONGER A RETAIL IA OR RR!

I AM that almighty "hedge fund manager" you THINK doesn't charge an admin fee and doesn't ever have a losing year. I charge a small admin fee and a % of gains. And as a retail IA I was mostly paid as a % of assets as well - the more client $ grew, the more $ I also made. I was not making much on commissions, except with the smaller investor (under 6 figures) who would get placed in a "transactional" account, as opposed to a "managed money" structure I did with 6 figure + clients. I've explained this several times.

I AM NO LONGER A RETAIL IA OR RR!

YOU are cherrypicking. Again, please show the board how well you've done in the ups and downs we've had the past 6 years.

Leave it to a "day trader" to expect anyone to beat the market every day, month, quarter, and year. Learn about risk management. That particular fund has been 70-75% cash for quite a while now - that manager has been cautious much like I and many others have in the last year plus due to various macro factors. The reason the market is currently beating it or at least matching it is because it is currently heavy in cash because the overall market has gone beyond where it really should be. The fed is printing and pumping money and keeping rates artificially low. Some think we'll see a 25-50% market decline once they stop this nonsense.

That fund actually is not even available at retail firms or banks, etc. Anyone who wants to invest in that fund must do so directly through that fund. Not I nor any other money manager, broker, or whatever makes any $ off that fund - they are totally self-contained. I invest a few bucks in it and make others aware of it because the guy obviously knows what he is doing. I DON'T recommend putting everything into that or any other investment.

And I just love the way you say people who invest in mutual funds aren't doing "real investing". I guess the returns and the money are "fake"? A normal person who invests a million with a realistic goal of having 8 figures in 20 years doesn't care how they do it. But they typically prefer the least amount of risk in doing it if they're smart and not investing with their emotions.

Again, you have unrealistic expectations. You won't beat the market every year (much less every day or month), and if you day trade and trade futures, you'll likely be broke in a few years. Statistics and my own experiences and interactions with thousands of people confirm that the odds are great that you'll lose it all if you do it long enough. And you obviously invest (if you even actually do invest) with your ego.

Ego investors / traders always get stomped out pretty quickly. While most investors and investment professionals have the end goals of retiring with a nice nestegg and increasing our net worth throughout our lifespan, leaving our heirs a nice pile of dough, etc, ego investors are only interested in the quick buck, or more accurately bragging about the quick buck. But it has to be a quick buck that is made in a way that is overly complicated and "cool" or "sexy" or whatever. Trading, options, futures, shorting, etc (and perhaps hedge funds?) are the only "cool" ways to invest to the typical ego trader. Traditional investing is "lame", no matter how good the results. Money made by handing $ over to a top fund manager(s) or other professionals, or by holding positions a little while and not making things overly complicated is "not real investing", correct?

You'll take limited gains or even substantial losses to the point of going broke as long as you're the one directly calling the shots and not having to pay anyone fees. You're convinced that not only is the whole industry a scam, but that you know better than anyone. I too thought I would be the greatest thing the world ever saw many years ago when I took my low six figure savings and decided to trade for a living. Luckily I had the sense to realize that day trading was a fool's game before I lost a whole lot of $.

Investing among professionals is certainly competitive, but again a novice with little or no market knowledge trying to constantly time the market, doing short term technical trading from home with limited tools, limited funds, and limited info is extremely likely to get stomped out quickly. Then you'll be screaming about how the whole thing is "rigged" against the small investor, etc. Small investors willing to take a little risk can make lots of $ riding the coattails of the big boys. But it sounds like you think you're as good or better than them. I thought I would be as well. I thought I'd turn $100k into billions within a few years.

Icahn and Buffett have both turned that exact amount into tens of billions, but it's taken them both many decades of smart investing. And they've also made $ off investors' money. I have some $ in both IEP and BRK.B - far more in IEP. I have also made lots of $ riding Icahn's coattails. But it can be risky.

Where it's REALLY competitive is in gathering assets. Everyone who knows the markets knows that you cannot always win and cannot make anywhere near triple digit returns or even mid double digit returns consistently. The higher you set the bar for returns, the more risk you're taking. The more risk you're taking, the greater the chance of losses. And the more concentrated you are and more you do things such as short individual high beta stocks, commodities, etc, the greater your losses will be.

As for Templeton, I mentioned one fund that any idiot can see is a very good, relatively low risk way to get asset diversification and even a bit of alpha in their portfolios. They have many, many funds. I like a few, most are just average and don't impress me.

You cannot have returns without risk. Generally they tend to be pretty strongly correlated.

As for your latest gem that the whole thing is basically a zero sum game that doesn't build wealth and only moves it around, that's another fallacy your day trading pimps who are selling you materials and info want you to believe. Companies DO grow.

Again, you've already got your mind made up, you know it all, and you don't want or need any info that does not jell with your narrow view of things. You don't care about being very wealthy in 20 or 50 years - it's all about the quick buck. You have no interest in how investments have done or will do in 5,10, or longer year time frames. And you don't need risk management, because you're too smart to ever be wrong. My guess is that you're pretty young, and you probably spend a great deal of $ on flashy things and invest a great deal of time and money into how people see you and don't care about building actual long term wealth - much like others here.

Good luck.

So as a retail brokerage IA, you would be paid commissions regardless of whether your customers made profits or not? That makes you a salesman, like all brokers. That is not to be confused with someone that can make a return for their customers.

And it seems you are still selling. Oceanstone is a prime example.

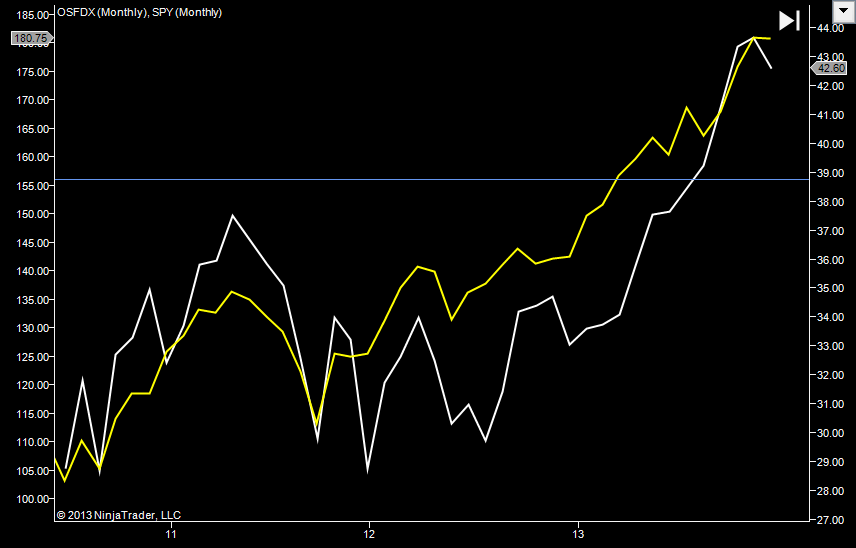

Here is Oceanstone (white) vs the SPY (yellow). SPY is just a plain old index tracker. Oceanstone charge you 1.8% per year for the privilege of being in their fund. SPY costs you .09. Oceanstone have offices to pay, marketing costs, commissions to guys like you, company cars - and of course their 'professional investors' - who in the past 3 years have done nothing at all but slightly under perform a completely passive SPY.

Now, of course, in 2009, after the crash - Oceanstone picked up a lot of undervalued stock and they got a massive return. This is to be expected and makes a lot of sense in HINDSIGHT. Trouble with hindsight and your cherry picking historical high peformers to "wow" the board, this does nothing in terms of future returns. In fact, perhaps the best way to guarantee poor returns is to invest in last years high performers.

So yeah, Oceanstone is currently crap. It is performing worse than the S&P500 at the moment. Do they pay good commissions?

What no IA will tell you is that the market cannot create money. Only what goes in can come out. Still, everyone expects to take out more than they put in and that's AFTER IAs, Funds, exchanges take their cut. When you invest you are competing against other investors to take more from a finite pool of money than you put in.

Investing/trading is a competitive endeavor.

In terms of Templeton, I would advise any would-be investor to download 5 years worth of performance figures for their funds. Track how the to 10 performers for any one year do in the next year. What you will boil it down to is the fact that YOU have to choose the funds your money goes into. Your IA will give pointers but will leave it in your hands. So you have to decide what will do well next year. Hell - if you could do that, then you wouldn't be looking for investment advice in the first place.

The whole thing is a scam.