Have to jump in here, despite my self-imposed absence until 125. Onbsidian is very good at trolling me, and sometimes he get a little bite.

The irony of this post from an Eth fan, is that this issue already exists with Eth and other POS coins (including fiat currencies). Proof of Stake leads to centralization, due to dynamics that increasingly concentrate power in the hands of a few large stakeholders. We see this right now with the emergence of "Eth Treasury companies" (which is actually a nonsense in itself, for anyone who understand what the purpose of a treasury in a listed company is - I will explain in more detail on my return). In POS, the chances of being chosen as a validator and earning rewards is directly proportional to the amount of cryptocurrency staked. That results in larger stakeholders have a higher chance of validating blocks and accruing more rewards, leading to a cycle where they become even more dominant due to their increasing "stake". What we are seeing, with larger Eth staking pools, is that where multiple users pool their tokens to increase their chances of validation, can further exacerbate centralization. This was what many were concerned about the outset, and now we see it happening.

Back at BTC 125K...

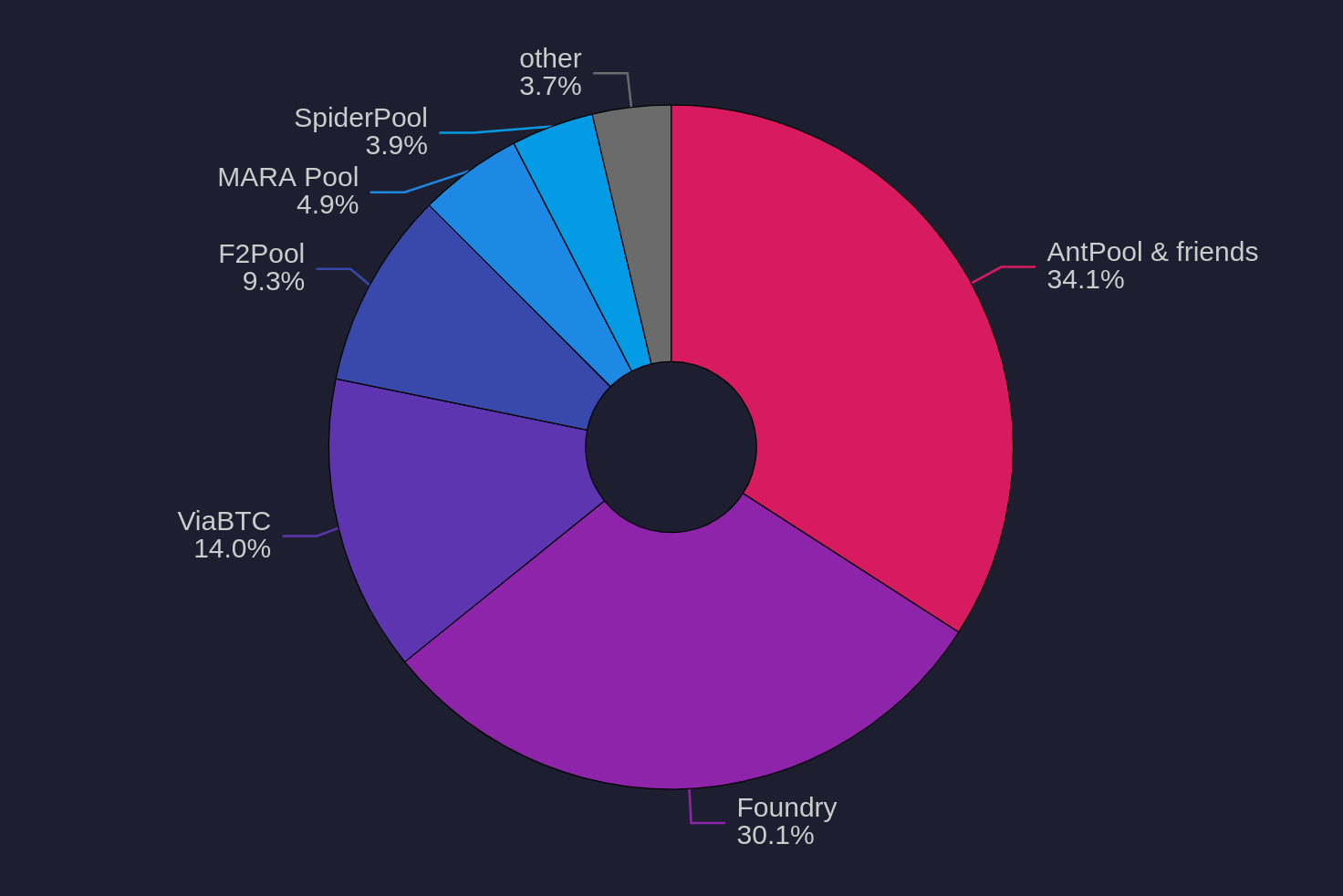

Bitcoin mining is significantly more centralized than ETH staking. Ethereum has built-in accountability — dishonest validators get slashed and permanently lose their stake. Bitcoin miners, on the other hand, face no such penalty. If they attack the network, the only cost is electricity, and they can return to attack again. An ETH validator would need to keep buying more ETH only to have it slashed repeatedly, creating a far stronger deterrent.

Now consider Bitcoin’s economics. Under PoW, block rewards halve every four years. Imagine accepting a job where your salary gets cut by 50% on a fixed schedule. Would you sign up for that, gib?

For miners to survive, BTC’s price must more than double every four years just to compensate for halvings and dollar inflation. And after 16 years, transaction fees still account for only about 1% of miner revenue. When does that change? And more importantly, how do you force users to pay more for transactions when alternatives exist?

Ethereum solved this with staking economics and slashing incentives that reward honesty and punish attacks. PoW looks like a race to the bottom while Proof of Stake looks like the future.

BITCOIN BLOCK REWARDS

3.125000 BTC (2024) 1

################################################################

1.562500 BTC (2028) 1/2

################################

0.781250 BTC (2032) 1/4

################

0.390625 BTC (2036) 1/8

########

0.195313 BTC (2040) 1/16

####

0.097656 BTC (2044) 1/32

##

0.048828 BTC (2048) 1/64