I was genuinely in the Dubai India region for business/holiday

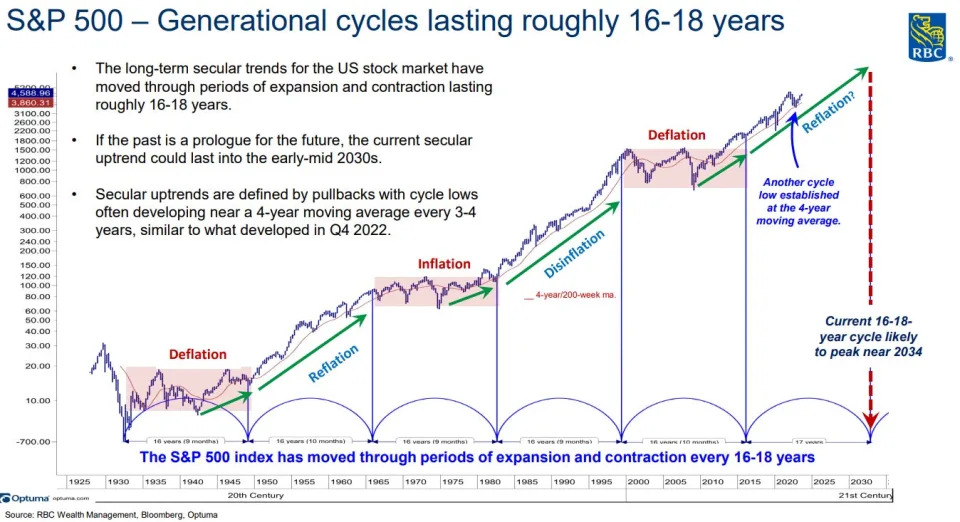

Interesting permabull chart I think you'll enjoy. It goes up for another decade and then sideways for 16-18 years.

LoL nice 😂

On face value that chart looks magic but itís not correct as the economic productivity boom will occur in 2030 onwards.

the 3 photos I attached are S&P vs inflationary CPI pumps. I look for 3 pumps. Post 3 pumps itís up only for a decade plus.

IMO follow the 40s for now. GDP is very nice right now, unemployment hasnít cracked, consumers are adjusting to higher rates, equities are priced on shit earnings which they will outperform.

From the bottom of CPI equities should rally something like 2yrs before the next sell off begins. Doesnít mean we wonít have a correction in Sep-Nov 2023 period.

We need to wait for the next CPI around August 2026 to see where rates are and what kind of equity sell off we get and how CPI comes down. In early 2029 you could be in a case of going all in on equities and riding it for 15yrs.

We need to wait for 2026 to occur